BTC ETFs Bounce Back with Inflows, While Ether Bleeds Out

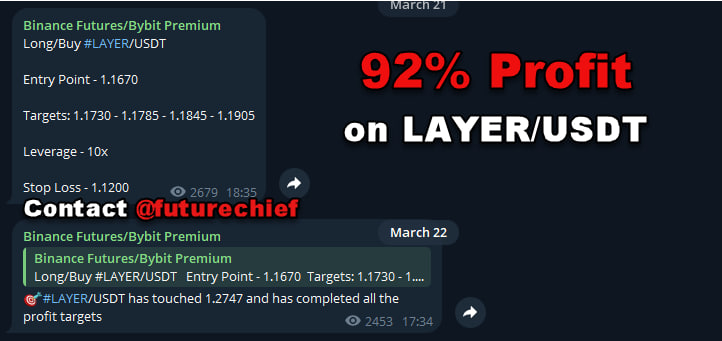

Click on the link to make sure you make a steady profit in Binance futures trading. Get free Bitcoin trading signals and use the Cornix trading Bot for smart automated trades: https://telegram.me/binancefuturesignal

Bitcoin ETFs snap a five-week net outflow streak while Ether-based funds have a fourth consecutive red week.

Spot Bitcoin exchange-traded funds (ETFs) in the US snapped a five-week net outflow streak in the trading week ending March 21.

Bitcoin ETFs clocked a net inflow of $744.4 million — the biggest tally in eight weeks — extending their daily inflow streak to six consecutive days, according to data from SoSoValue.

Earlier this year, Bitcoin ETFs recorded their largest net inflows of 2025: $1.96 billion in the week ending Jan. 17 and $1.76 billion the following week. Bitcoin surged to an all-time high of $109,000 on Jan. 20, the inauguration day of US President Donald Trump.

We boast a top-tier team in the trade market, equipped with an in-depth understanding of market behavior and trends. Their expertise positions us as leaders in navigating the dynamic world of trading.

Our full-time crypto traders are highly skilled in market analysis and trading strategies. Their dedication ensures that our decisions are well-informed, contributing to our success in the crypto trading landscape.

Visit the link provided to explore our team's performance metrics, signal accuracy, and testimonials from satisfied members. It's a snapshot of our proficiency and the positive impact we've made in the trading community.

Comments

Post a Comment